In today’s litigious society, a single, catastrophic lawsuit can wipe out years of hard-earned assets and future financial stability. While standard insurance policies—such as homeowner’s, auto, and renter’s insurance—provide foundational protection. Their liability limits are often quickly exhausted in the face of severe injury or major property damage claims.

This is where the Umbrella Liability Policy steps in. Far from being a luxury item, the umbrella policy is a crucial, often inexpensive. Layer of defense designed to provide liability coverage above and beyond the limits of your primary policies. It acts as the ultimate safety net, protecting your accumulated wealth, including savings, investments, and future earnings, from devastating legal judgments. Understanding the strategic advantage of this policy is essential for anyone seeking comprehensive financial security.

What Exactly is an Umbrella Liability Policy?

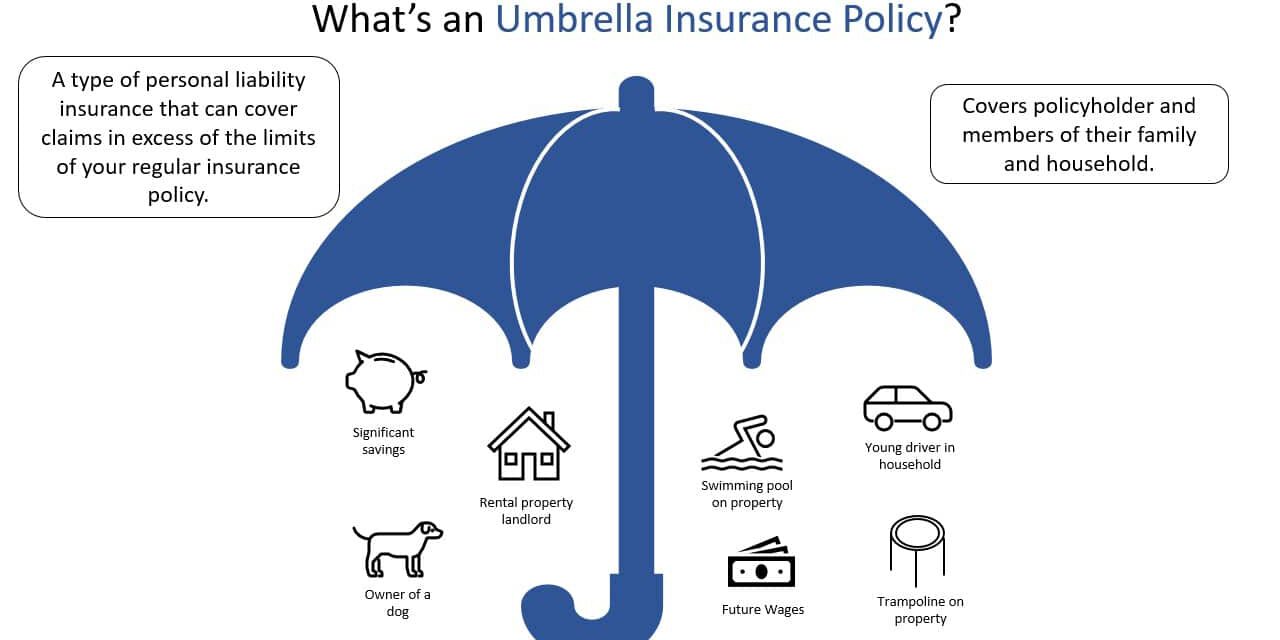

An umbrella policy is a type of personal liability insurance that serves two primary functions:

1. Excess Liability Coverage

This is the policy’s main job. If you are found legally responsible for damages that exceed the liability limits of your primary insurance (e.g., your auto policy covers $300,000 for injuries, but the court awards the victim $1 million). The umbrella policy kicks in to cover the difference (the remaining $700,000). Without it, that $700,000 would be paid directly from your personal assets.

2. Broader Coverage Scope

Umbrella policies often cover liability claims that are entirely excluded or only partially covered by primary policies. This can include:

- Slander and Libel: Claims related to defamation of character (written or spoken).

- False Imprisonment: If you own rental property, claims related to wrongful eviction.

- Liability Coverage While Traveling: Extending coverage globally, whereas primary policies may be geographically limited.

Because the umbrella policy assumes risk only after the primary insurance limits are exhausted, insurance companies require applicants. To maintain certain minimum liability limits (often $250,000 or $500,000) on their underlying homeowner’s and auto policies before the umbrella policy will be issued.

Why Standard Limits Are No Longer Enough

The cost of medical care and legal settlements has risen exponentially, meaning that even a seemingly minor event can lead to multimillion-dollar liabilities.

The Reality of Catastrophic Claims

Consider scenarios where standard limits are easily breached:

- A Multi-Car Accident: You are found at fault for a severe highway accident involving multiple vehicles and serious injuries to several occupants. A court judgment can quickly reach seven figures.

- Injury on Your Property: A guest or service worker suffers a permanent. Life-altering injury (like a spinal cord injury) in your home or on your rental property. The damages awarded for lifetime medical care and lost wages are massive.

- Teen Driver Incidents: If you have a young, inexperienced driver in the household. The risk of a high-severity accident increases significantly, placing the parents’ assets directly at risk.

In these cases, the umbrella policy serves as the critical buffer, protecting assets like savings accounts, retirement funds, college funds, and the equity in your home. Without it, these assets become targets for liquidation to satisfy a judgment.

The Cost-Benefit Analysis: A Highly Efficient Investment

One of the most attractive aspects of the umbrella policy is its relatively low cost compared to the massive coverage it provides.

High Coverage for Low Premium

Because the umbrella insurer is only exposed to risk after the high limits of the primary policies have been exhausted, the premium is quite modest. A typical $1 million umbrella policy might cost between $150 and $300 per year. Subsequent layers of coverage (e.g., up to $5 million) are generally even cheaper per million.

When weighed against the potential for a $1 million or $2 million judgment, the annual premium represents one of the most cost-effective forms of financial security available. It is a protective measure designed to safeguard everything else you have worked to accumulate.

Who Needs an Umbrella Policy?

While often mistakenly thought to be only for the extremely wealthy, an umbrella policy is essential for anyone whose net worth exceeds the liability limits of their primary insurance, or whose lifestyle inherently involves higher risk.

- Asset Owners: Anyone with significant savings, investments, or home equity that could be targeted in a lawsuit.

- Homeowners and Landlords: Property owners, especially those with pools, trampolines, or rental properties, face increased liability exposure.

- High-Risk Drivers: Individuals with long commutes, multiple vehicles, or young drivers on their policy.

- Individuals with High Income: Even if your current assets are low, a court can garnish your future wages to satisfy a judgment. An umbrella policy protects your future earning potential.

Conclusion: Protecting Today’s Wealth and Tomorrow’s Income

The Umbrella Liability Policy is the cornerstone of modern, comprehensive financial planning. It is a strategic defense against the catastrophic, low-probability, high-impact events that can instantly erase a lifetime of careful saving and investing. By providing excess coverage and broader protection against complex claims like libel and slander, the umbrella policy ensures that your foundational insurance is not your final defense. Investing a small annual premium to secure millions in liability coverage is the definitive way to safeguard both your current net worth and your future income streams from the risks inherent in daily life.