The cornerstone of strategic decision-making in the corporate echelons, the Business Intelligence (BI) report is the navigational compass steering businesses through the vast sea of data. In this article, we delve into the intricacies of BI reports, exploring their significance, structure, and the art of transforming raw data into actionable insights.

The Anatomy of a BI Report

A BI report is not just an assemblage of charts and graphs; it’s a meticulously crafted narrative that unveils the story within the data. From KPIs (Key Performance Indicators) that serve as the guiding stars to trend analyses that decipher historical patterns, each element is a brushstroke contributing to the canvas of informed decision-making.

The report structure typically encompasses an executive summary, data visualizations, analyses, and recommendations. A judicious combination of textual insights and visual representations ensures that stakeholders, regardless of their analytical acumen, can glean valuable information.

Data Mining: Extracting Gold from the Digital Mines

At the heart of BI reports lies the process of data mining, a digital prospecting expedition aimed at extracting valuable nuggets of information from vast datasets. Association rule mining, cluster analysis, and regression analysis are the pickaxes and shovels in this digital mine, unearthing correlations, patterns, and outliers.

Advanced algorithms, often draped in the cloak of machine learning, traverse the labyrinth of data, unveiling hidden relationships that human intuition might overlook. It’s not just about data; it’s about discovering the narrative concealed within the numbers.

Data Warehousing: The Architectural Pillar

Behind the scenes, the BI report draws its strength from the architecture of data warehousing. A well-structured data warehouse serves as the repository, organizing data in a manner that facilitates efficient querying and analysis. It’s the architectural pillar that supports the analytical edifice.

Data warehousing involves the extraction, transformation, and loading (ETL) of data from various sources into a centralized repository. This organized structure enables swift retrieval and analysis, transforming raw data into actionable intelligence.

The Art of Visualization

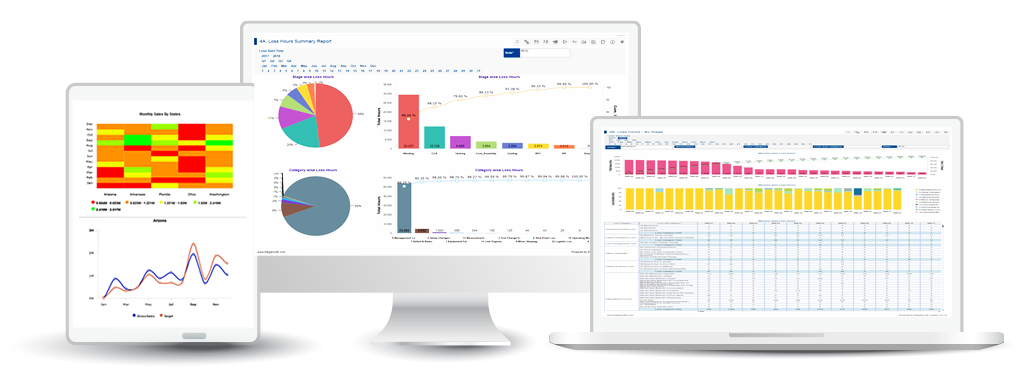

Numbers, no matter how insightful, often fall short in conveying the full spectrum of meaning. This is where the art of visualization comes into play. From heat maps that highlight patterns to bubble charts that juxtapose multiple dimensions, the visual elements in a BI report are the storytellers.

The selection of the right visualization is an art form. It’s about translating complexity into simplicity without sacrificing nuance. A well-crafted visualization not only elucidates data trends but also captivates the attention of stakeholders, making the insights more memorable and actionable.

Prescriptive Analytics: Beyond Descriptive Narratives

BI reports transcend the realm of descriptive analytics; they venture into the realm of prescriptive analytics. It’s not merely about narrating what happened; it’s about providing recommendations on what to do next. Prescriptive analytics employs advanced algorithms to suggest the most optimal course of action based on the analyzed data.

It’s the evolution from hindsight to foresight, empowering decision-makers with actionable intelligence that extends beyond historical narratives. The BI report becomes a strategic advisor, guiding businesses towards proactive decision-making.

Real-Time BI: Navigating the Tide of Immediacy

The contemporary business landscape demands immediacy in decision-making. Real-time BI is the sail that allows businesses to navigate the tide of immediacy. Through data streaming and real-time analytics, organizations can respond to market dynamics, customer behaviors, and operational challenges with agility.

Real-time BI transforms the traditional static report into a dynamic compass, providing real-time insights that enable businesses to seize opportunities and mitigate risks swiftly.

Conclusion

In the dynamic dance of data and decision-making, the BI report emerges as the virtuoso. From the intricacies of data mining to the architectural strength of data warehousing, every element plays a role in crafting a narrative that transcends raw information. As businesses navigate the complexities of the digital age, the BI report stands as an indispensable tool, unraveling insights that guide them towards success in an ever-evolving landscape.